4 Reasons Why You Should Stop Using Checks for Grant Distribution

The process of issuing and distributing checks for grant payments is becoming increasingly outdated. There are a number of reasons why using checks is no longer the best option for grant distribution, including:

- The time they take to get credited/cleared

- They are subject to fraud and theft

- Once paid, they are untrackable

- Transaction fees are typically higher.

Now that you know why to stop using checks for fund distribution, let’s break these down further and explore the best alternative to using checks!

1. Checks Take Time To Get Credited

On average, checks take two business days to clear. That is, once they are received by the party you submit them too. In many cases, they can take longer depending on several factors, such as deposit frequency, the amount of the check, and your relationship with the bank.

When you’re trying to keep track of your grant funds, knowing the status of the payment in transit is critical not just for your own knowledge, but to help you with the inevitable questions you will receive from your donors and recipients. In many cases, your grantees are anxiously awaiting this money, and want to start using it quickly. If they receive it on a Friday, or worse right before a holiday, there could be several days before they can actually use the funds.

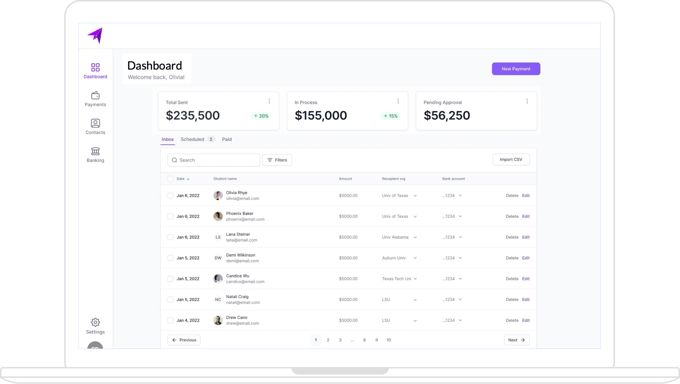

Automated funding usually clears much faster. That’s why many grant programs have opted for grant management software - to get the money in the hands of their recipients that much faster.

2. Paper Check Fraud Still Happens

No one likes to think about this, but a significant reason for why to stop using checks is that check fraud and theft are still common crimes. In fact, check fraud is one of the causes for banks taking so long to cash checks… They know that criminals love using checks to steal money from hardworking folks!

Even as recently as 2023 (AFP) reported, “71% of organizations report having been victims of payments fraud activity” with checks and ACH debits being the most susceptible to payments fraud.

There's a reason why check fraud is so prevalent, even with today’s advances in technology. Using checks to steal money is easy to do! Nefarious individuals know that fact – and they take advantage of it. The worst part is victims of check fraud don't know what's going on until it's all but too late. If that happens to you, you have to undergo a tedious process to get your money back - that is if you even can get it back. Which brings us to the next reason to switch to automated fund distribution…

3. Once Paid, The Check Money's Usage Is Untraceable

Why use grantmaking software? If you need to track where the money went. Here’s the thing - Unfortunately, there's no way to trace a bad check when the bank cashes it, so you're often out of luck if and when it happens.

If someone steals an envelope containing unsigned checks, they will gladly forge a signature and take it to a cash advance or financial institution. If the business doesn’t catch wise to what is happening, the thief could get away with the money, and you’re left trying to explain to your recipients and donors what happened.

4. Cost Of Transactions Is On The Higher Side

Consider this - To set up automated funding, your funds transfer will typically cost less than $3 for a $500 transfer. With a paper check, the average fee incurred will be around $8. To send a payment via credit card or wire transfer will cost you even more.

On your recipient’s end, the bank may charge 3% of the check to cash it. That's right! Banks will happily take a piece of both sides when someone cashes a check. Bottom line - it’s much cheaper to automate your funding and forgo paper checks altogether.

Checks Are Out, Grant Payment Software Is In

Need a bonus reason as to why to stop using checks? Checks still have a manual process involved in presenting and clearing them. Banks and law enforcement still struggle to stop check fraud. Unfortunately, it's not because of a lack of trying.

The trouble lies in how easy it is to steal money from businesses and individuals via check fraud. In a very real way, checks are ancient technology! It's a piece of paper anyone can write on – and criminals know how to take advantage of outdated things.

It’s why you should use grant payment software. As a grant program manager, it’s your best defense against check fraud as well as mitigating all of the limitations we’ve mentioned here today. It will also improve your user experience overall, and boost your reputation and profitability in the long run as well. And, the best solution on the market that will give you the best bang for your grant maker buck is SendGrant. Click here (Add CTA whenever ready) to learn more about what our software can do for you!

About the author

Founder and President of SmarterSelect. Responsible for company, product, and marketing strategies and execution.

WebsiteRead more posts by this author.